GST (Goods and Services Tax) Include

GST is a multi-stage, comprehensive and destination based tax in India.

It has replaced many indirect tax laws which exist previously in India where the tax is collected by the State where goods are consumed.

So it is a one nation one tax law of taxation for the entire country.

This module helps apply GST New Rule of Tax Inclusive to your Product Rate, you can also apply the tax on the base product as well as on category

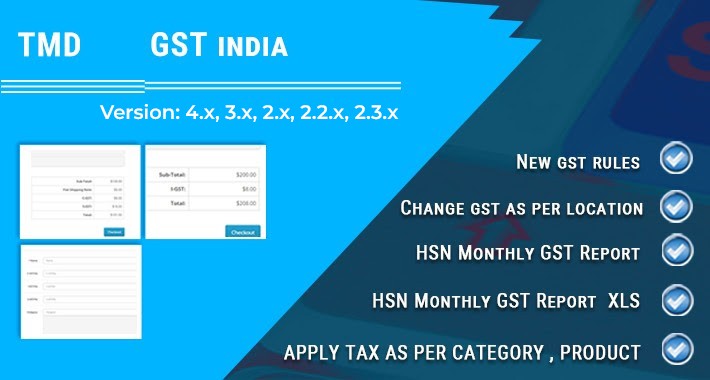

Features of TMD GST OpenCart Module (Inclusive of Tax)

1. Apply Tax as per Product & Category

GST brings one uniform indirect tax in all states, so it is easier for you to define universal one tax rate for your product on the product master.

It also enables you to define category wise GST rate under the category section

Also, you can assign multiple category and multiple products under one tax rate.

2. Set New GST Rules

Change or edit your tax rate any time you want depending on tax laws rate, product, and category whenever you want.

And also define your GST Name as per tax slabs

Also, you can modify the invoice template to show the GST for each product and select different rates product wise.

3. HSN monthly GST Report.

HSN Report is a summary of all the products and services sold over a month or a period.

And the HSN-wise report is auto-generated under TMD OpenCart GST reports

So you can verify it and upload your correct data to the GSTN portal.

4. HSN Monthly GST Reports XLS

In order to file your monthly HSN summary, you can export your HSN register to an XLS file.

And TMD OpenCart GST Module provides you with this option to directly export it from your website report.

So you can copy and paste it to other sources for creating your perfect reports for filing your returns.

5. Change GST as per Location.

You can fix your location from the master settings to set up your base location with your OpenCart store.

Depending on your base location, GST module assigns required taxes to local sale or an interstate sale.

So, suppose if your base location is in Tamil Nadu, the module will identify all of your sales orders from Tamil Nadu and set local GST to your orders, i.e CGST and SGST as per location identified.

And if the orders are from a different location it will identify and match your base location and set IGST to all orders if your business master location does not match with orders placed from a different location.

Benefits of GST for E-commerce Trade:

1. Defined treatment for e-commerce

2. Mitigation of cascading and double taxation

3. Online simple procedures under GST

4. Simple Tax regime

5. Regulating the unorganized sector

6. Composition scheme for small business

7. Increased efficiency in logistics

8. Development of common national market

9. Fewer rates and exemptions

10. More efficient neutralization of taxes especially for exports

11. Reduction in the multiplicity of taxes

support

It has replaced many indirect tax laws which exist previously in India where the tax is collected by the State where goods are consumed.

So it is a one nation one tax law of taxation for the entire country.

This module helps apply GST New Rule of Tax Inclusive to your Product Rate, you can also apply the tax on the base product as well as on category

Features of TMD GST OpenCart Module (Inclusive of Tax)

1. Apply Tax as per Product & Category

GST brings one uniform indirect tax in all states, so it is easier for you to define universal one tax rate for your product on the product master.

It also enables you to define category wise GST rate under the category section

Also, you can assign multiple category and multiple products under one tax rate.

2. Set New GST Rules

Change or edit your tax rate any time you want depending on tax laws rate, product, and category whenever you want.

And also define your GST Name as per tax slabs

Also, you can modify the invoice template to show the GST for each product and select different rates product wise.

3. HSN monthly GST Report.

HSN Report is a summary of all the products and services sold over a month or a period.

And the HSN-wise report is auto-generated under TMD OpenCart GST reports

So you can verify it and upload your correct data to the GSTN portal.

4. HSN Monthly GST Reports XLS

In order to file your monthly HSN summary, you can export your HSN register to an XLS file.

And TMD OpenCart GST Module provides you with this option to directly export it from your website report.

So you can copy and paste it to other sources for creating your perfect reports for filing your returns.

5. Change GST as per Location.

You can fix your location from the master settings to set up your base location with your OpenCart store.

Depending on your base location, GST module assigns required taxes to local sale or an interstate sale.

So, suppose if your base location is in Tamil Nadu, the module will identify all of your sales orders from Tamil Nadu and set local GST to your orders, i.e CGST and SGST as per location identified.

And if the orders are from a different location it will identify and match your base location and set IGST to all orders if your business master location does not match with orders placed from a different location.

Benefits of GST for E-commerce Trade:

1. Defined treatment for e-commerce

2. Mitigation of cascading and double taxation

3. Online simple procedures under GST

4. Simple Tax regime

5. Regulating the unorganized sector

6. Composition scheme for small business

7. Increased efficiency in logistics

8. Development of common national market

9. Fewer rates and exemptions

10. More efficient neutralization of taxes especially for exports

11. Reduction in the multiplicity of taxes

support

Price

$49.99

- Developed by OpenCart Partner

- 6 Months Free Support

- Documentation Included

Rating

Compatibility

4.0.1.0, 4.0.1.1, 4.0.2.0, 4.0.2.1, 4.0.2.2, 4.0.2.3, 3.0.3.8, 4.0.1.0, 4.0.1.1, 4.0.2.0, 4.0.2.1, 2.1.0.1, 2.1.0.2, 2.0.1.0, 2.0.1.1, 2.0.2.0, 2.0.3.1, 2.2.0.0, 2.3.0.0, 2.3.0.1, 2.3.0.2, 3.0.0.0, 3.0.1.1, 3.0.1.2, 3.0.2.0, 4.x.x.x, 3.0.3.0, 3.0.3.1, 3.0.3.2, 3.0.3.3, 3.0.3.5, 3.0.3.6, 3.0.3.7, 3.0.3.8, 1.5.6.1, 1.5.6.2, 1.5.6.3, 1.5.6.4

Last Update

12 Feb 2024

Created

21 Sep 2017

56 Sales

7 Comments

Login and write down your comment.

Login my OpenCart Account